One of the major elements of any Wealth Creation plan is the reduction of private debt (bad debt) as quickly as possible in order to beat the banks by reducing your interest payments to them.

Good debt vs bad debt

The key difference between good debt and bad debt is that good debt can be used to purchase assets that produce additional income for you, whilst bad debt does not. Bad debt works against achieving your financial success, rather than for it, and is generally non tax-deductible. Good debt can be beneficial in helping us to achieve our goals.

Reducing your tax bill

Your income tax is another debt to the Australian Tax Office that you need to pay regularly. It’s not something you have a choice over, but just like your mortgage you’ll benefit by finding a way to reduce this cost over time. When we put your personal wealth creation strategy together at Nestworth, we consider how your good and bad debts can play a role in reducing your tax bill over time. Often we can do this in harmony, where a reduction in your tax obligations can also assist in paying down your home loan sooner – freeing up money to help you live a Richer Life.

Understanding your cashflow

A key to achieving your financial goals is to establish a sound spending plan to ensure you have consistent savings. If you can save money, options open up to both investing and paying down bad debt.

Nestworth understands that life is never lived in a straight line. Your circumstances and goals are constantly changing, and finding regular savings can be easy at times and a challenge when least expected. It’s such an important area that we don’t like to leave it to chance.

We review your entire financial position to help you better understand it, provide a clear picture of where your money comes from, and more importantly, where it goes. It’s all a part of our cashflow analysis and monitoring service. We will work with you to determine your income and establish your spending plan to realise your savings.

We provide regular reporting of your actual income and expenditure to forecast and keep an eye on your monthly spending to make sure you’re sticking to your spending plan. If you’re off track, we’ll work with you to get you back on track to achieve the goals important to you.

How can we help you?

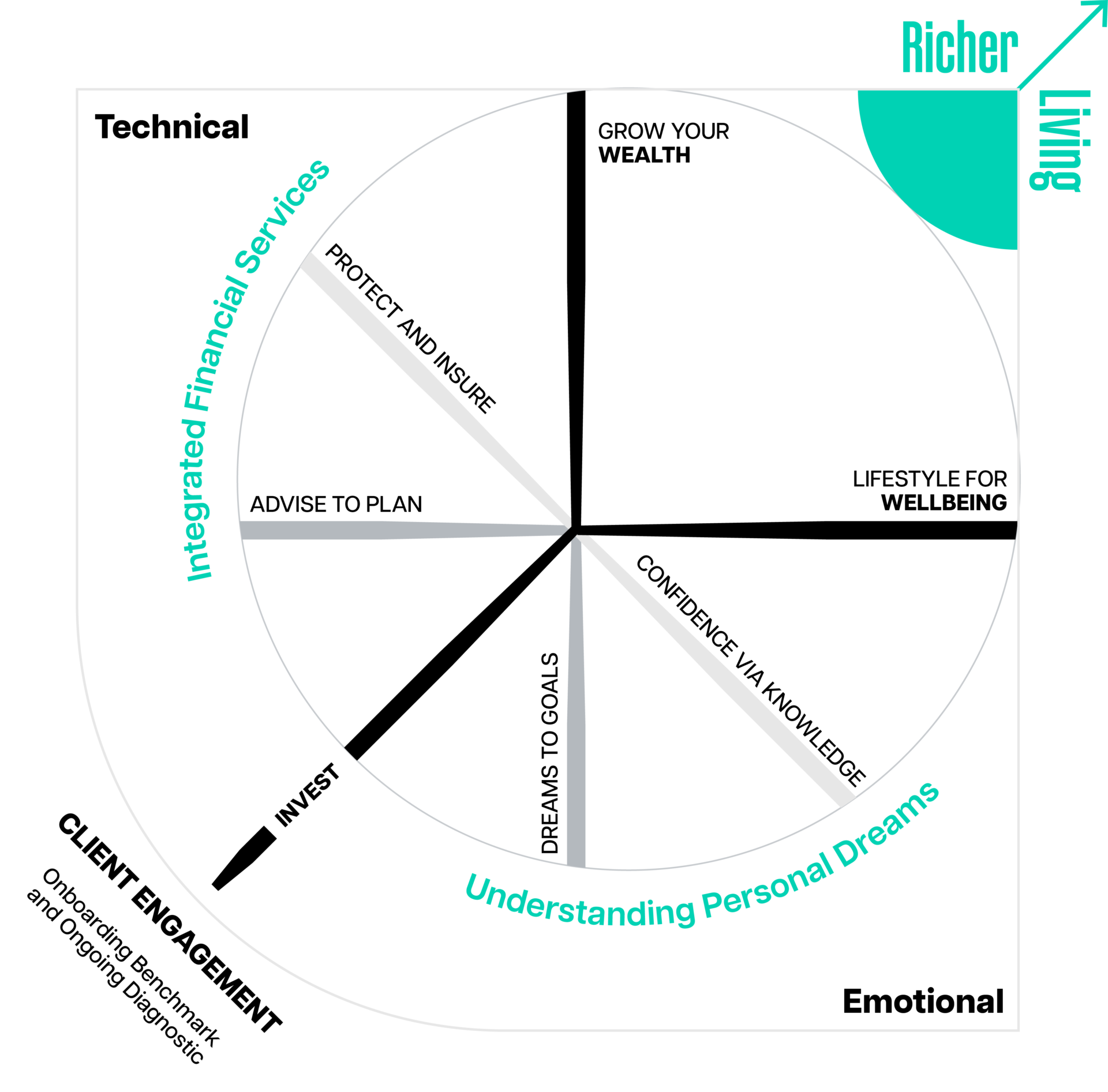

We work in partnership with you to advise, protect and grow your wealth with financial strategies tailored to help you secure your financial future.

With monthly progress monitoring, we are there to keep you on track for success and help navigate you towards achieving your idea of richer living.

Frequently asked question

Yes, we do assist with finding our clients the ideal mortgage. Our mortgage advisers work hand in hand with our financial strategists to ensure the best home loan is in place. They will find a home loan that not only has a competitive interest rate, but that also integrates smoothly with the rest of your financial plan.