At Nestworth we prefer to think about retirement as having the choice to work or not. With so many of our clients achieving financial independence earlier than they ever dreamed, stopping work entirely may not be the goal that you have immediately. Retirement might be a great time to start scaling back at work and enjoying a bit more “you” time. Imagine only working two or three days a week, but still taking home the same money?

We understand that Richer Living aspirations continue beyond your work life, and we ensure that your financial strategies can provide the life that you’ve worked so hard for.

Regardless of what ‘retirement’ looks like for you, we ensure that every Nestworth client plan considers a rich retirement life. If stopping work is a long way off, we’ll balance your superannuation and other investment strategies with the family priorities that are so important now.

If you’re seriously considering retiring soon, a Nestworth retirement plan will ensure that you maximise the longevity of your savings and minimise the taxation obligations you have.

Retirement Life

Our experience shows that your life after work won’t be a constant one. You’ll likely have a lot of experiences to check off in the years after retiring. And you’ll need the funds to make this happen. We work closely with our clients to ensure we understand their purpose and ambitions after their work life stops, and we build this into their financial plan. We know that this can be an expensive time, and we ensure that you can approach your new goals with confidence.

We also know that considerations such as Aged Care and other support services may be eventually needed. This may be down the track, but at Nestworth we like to have all events planned and funded. So, your financial strategist will discuss the best ways to ensure that you will always have the ability to make the choices that are important to you.

That’s Richer Living in retirement.

How can we help you?

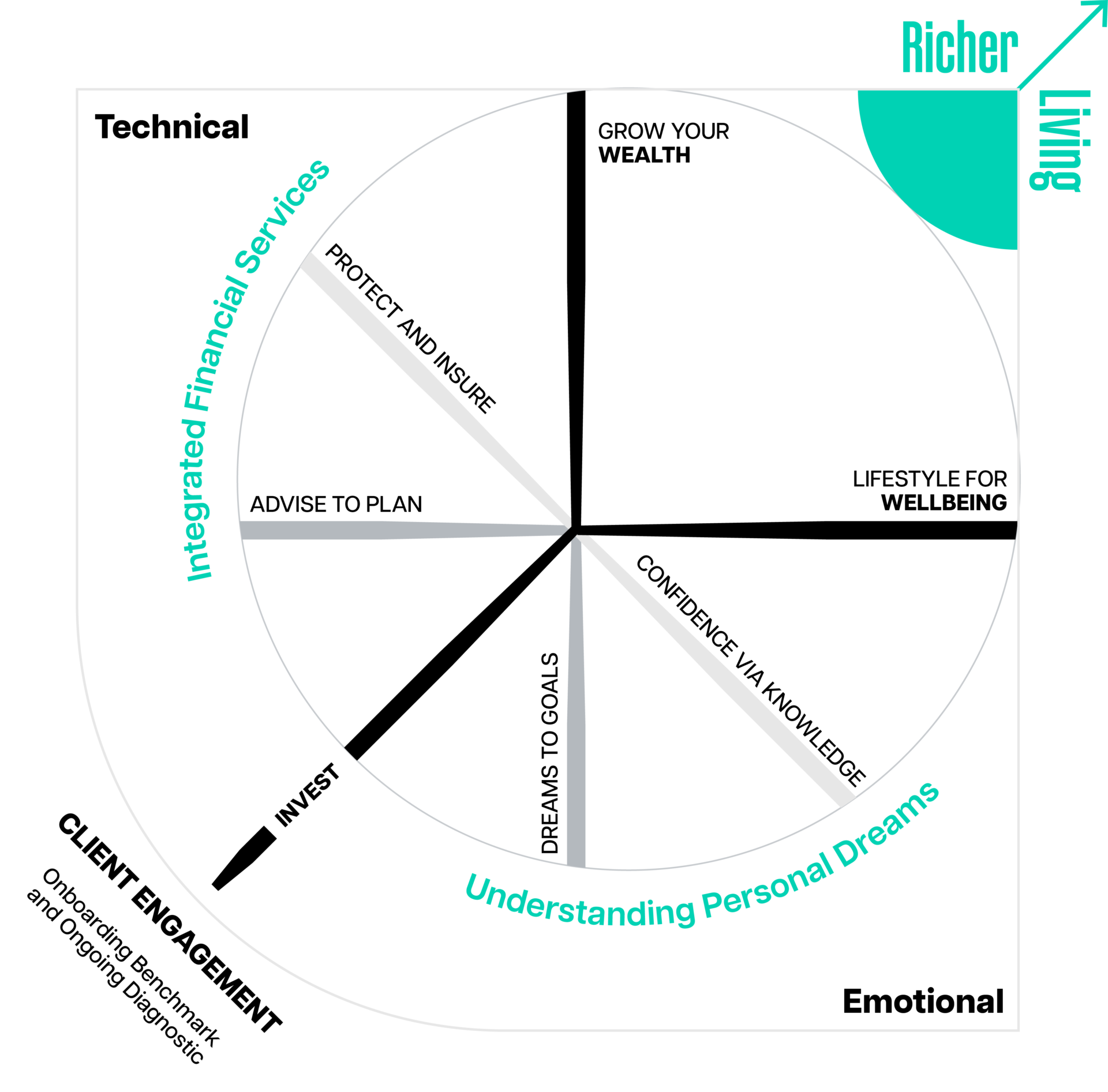

We work in partnership with you to advise, protect and grow your wealth with financial strategies tailored to help you secure your financial future.

With monthly progress monitoring, we are there to keep you on track for success and help navigate you towards achieving your idea of richer living.

Frequently asked question

It’s never too soon. All Nestworth clients have retirement planning incorporated into their financial strategies. This allows for many more options, and ultimately, a better life in retirement.