The ‘trick’ with superannuation for most of us is that you generally can’t access your money until you are at least 60.

This means it keeps growing over the years for you to enjoy later. But it has limitations if you want more from your overall savings plan.

How does it work?

Your superannuation fund receives your superannuation contributions from your employer. You can also make voluntary contributions from your pay or your bank account to increase your final superannuation balance. In some cases, there are tax and other advantages for doing this, however this does depend on your situation and your goals. And there are real traps and limits in place when contributing funds to super.

The money in your superannuation fund is invested in the hope that it will grow, and in most funds you can have a say over how your money will be invested. For example, you may be able to choose to have your funds invested in shares, property, cash or fixed interest – or a mix of these. But returns and risks can vary, and you need to carefully work through the best option for you considering your goals and time of life.

Nestworth can help you better understand super and select a superannuation fund and investment options right for your situation - given your situation and goals - so you can achieve success in retirement.

Why is it important?

It’s about saving for your future. As our life expectancy increases, many of us might have to fund a 30 plus year retirement. While there may be some type of age pension available to you, it probably won’t be enough to fund what you want from life. Many of us will need far more money than those before us to live a comfortable retirement.

The best part of superannuation is that if invested correctly it grows and grows. How much you have in superannuation will depend on the wise choices you make today.

How can we help you?

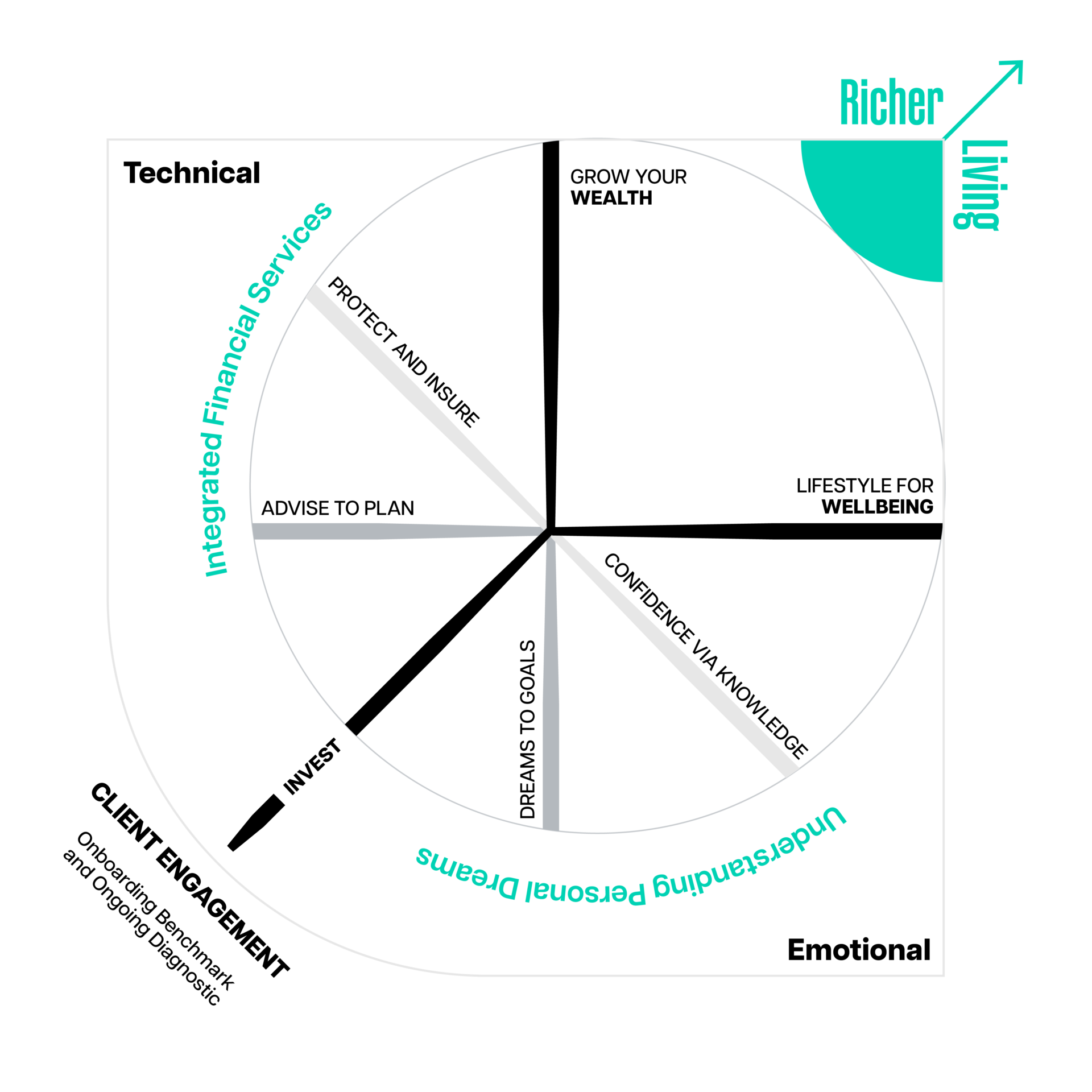

We work in partnership with you to advise, protect and grow your wealth with financial strategies tailored to help you secure your financial future.

With monthly progress monitoring, we are there to keep you on track for success and help navigate you towards achieving your idea of richer living.

Frequently asked question

It’s rare that your default superannuation arrangement will provide the right mix of investment outcomes and taxation benefits for you. These have been designed to work across a large number of investors, and are rarely tailored specifically for your needs. By considering your superannuation arrangements alongside your broader investment and protection plans, we can often make changes that will bring you very material benefits over time. Many aren’t aware of what they’re missing out on, or don’t take action soon enough.