In a perfect world, we’d all live forever and in perfect health. Unfortunately though, the world isn’t perfect. Knowing what will happen to you and your assets if you are unable to make decisions, or in the event of your death, can be quite morbid and at times overwhelming. However, it is important to all of us.

You need to know that your wishes will be honoured to reduce stress and confusion on your loved ones should the worst happen.

Wills

A Will is a legal document that outlines what should happen to your assets and belongings in the event of death. Having a clear and valid Will is the best way to ensure that your assets are protected and distributed according to your wishes. As time goes on and life changes, Wills should be updated and regularly checked for relevance.

Enduring Power of Attorney

An Enduring Power of Attorney (EPOA) is a legal document in which you appoint another person to act on your behalf if you are unable to manage your financial, legal and personal affairs, make decisions in respect to your health and personal matters due to incapacity.

An Advance Health or Care Directive

An advance directive sets out in more detail how you wish to be cared for. It is a formal way of giving instructions for your future health care and comes into effect only if you are unable to make your own decisions. It can take a big burden away from your loved ones when decisions of this nature need to be made quickly.

Testamentary Trusts

Testamentary Trusts are created in a will and are activated upon death. Instead of assets passing directly from one person to another, the assets are passed to the Testamentary Trust and then administered by a designated trustee – usually family members, a trustee company, or specialist solicitor. They can play a vital part in family arrangements to ensure certainty and manage tax affairs.

At Nestworth we believe that a complete and up to date Estate plan is an essential strategy to ensuring your family is supported and your assets are protected. We work closely with required specialists to ensure that your Estate plan is integrated with your wealth creation and retirement strategies.

How can we help you?

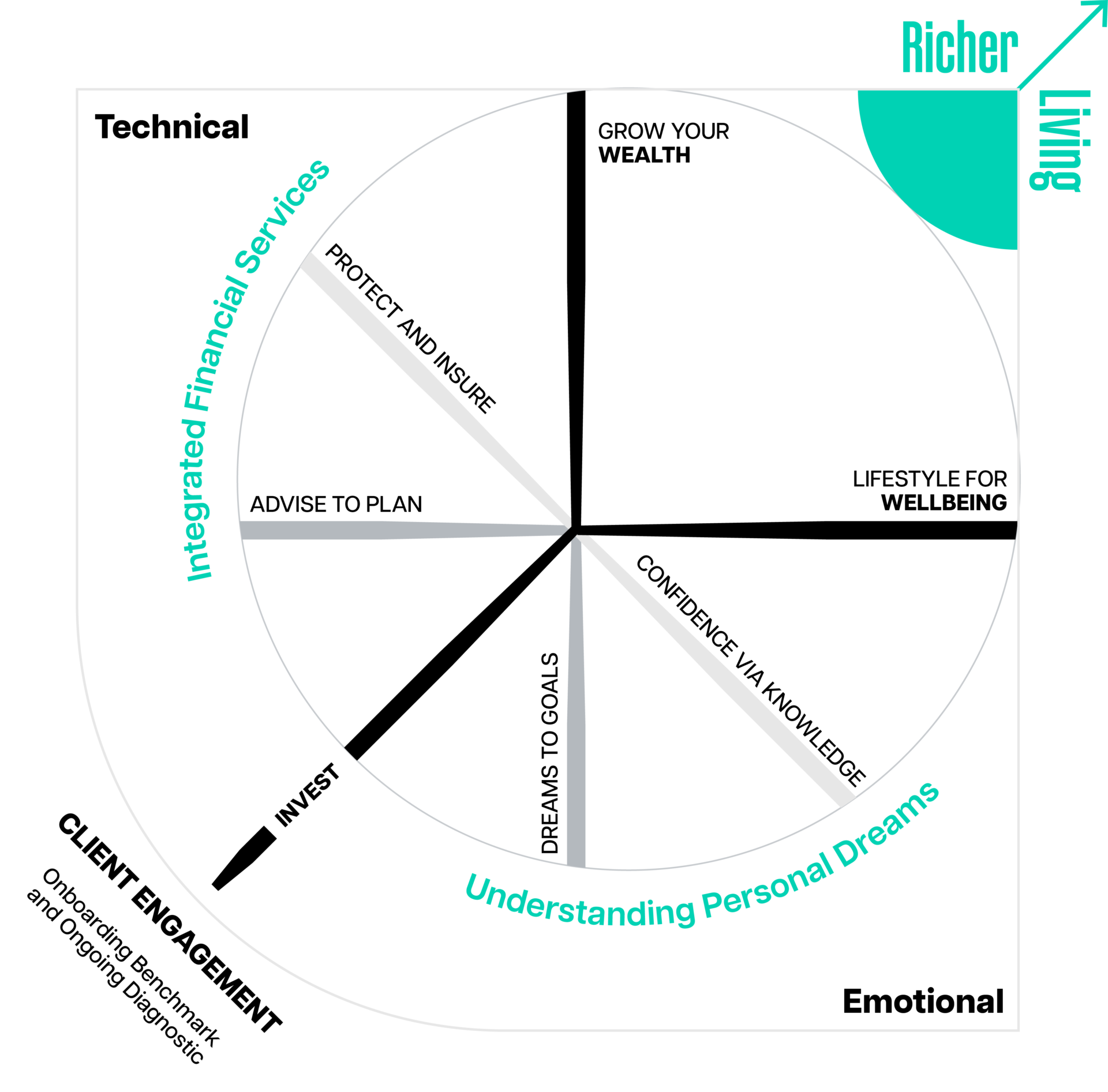

We work in partnership with you to advise, protect and grow your wealth with financial strategies tailored to help you secure your financial future.

With monthly progress monitoring, we are there to keep you on track for success and help navigate you towards achieving your idea of richer living.

Frequently asked question

Not directly, but we can ensure that you and your lawyer understand the considerations to get this important area right. We can also recommend the right specialist to bring your estate plan up to date, and work with them to ensure that all recommendations are fully implemented.