Yet the difference between home lenders and the loans they offer is not always clear. What’s more, the cheapest home loan (including the interest rate) isn’t always the best home loan for your situation! You can see why trying to navigate the mortgage market yourself can certainly be confusing.

That’s why more and more Australians are seeking the advice and expertise of an independent mortgage broker to help them find the best possible home loan for their needs.

How an independent mortgage adviser can help you

Whether you’re looking for a loan for your first home, renovations, your next home, or even a rental property, an independent mortgage adviser can help you find what you need.

Because they’re not associated with any one bank, Nestworth’s team of mortgage advisers can take an objective view of the many home loan products on offer, before weighing them up and recommending a short list of the loans that will suit your needs.

Better still, a Nestworth Mortgage Adviser can work with your Financial Strategist to show you how to pay off your mortgage years ahead of schedule – and save you a great deal of interest at the same time.

Of course, everyone wants to save interest on their mortgage. The question is, do you want to save thousands of dollars in interest? Or would you prefer to save tens of thousands of dollars?

That’s why simply looking for the lowest interest rate may not be the best answer. Instead, you need the right structure around your home loan, together with a clear debt reduction strategy.

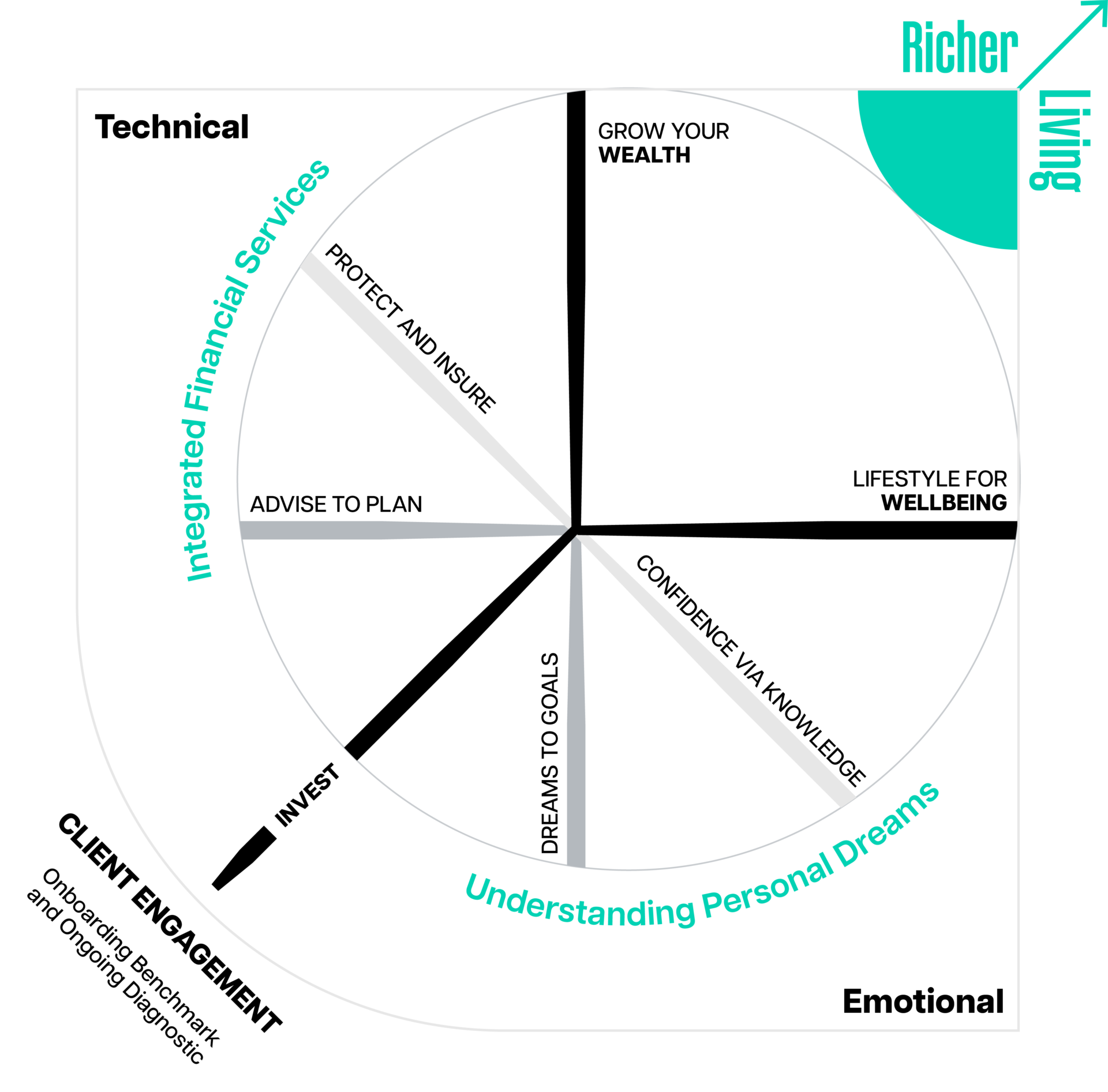

At Nestworth we don’t simply look at your home loan in isolation. Instead, we consider what really matters — working with you to look at the bigger picture of your finances, and how your mortgage can fit in with your overall strategy as a tool for wealth creation and facilitating your life goals.

Rather than focusing on just paying off your home loan we can help you to plan for future home improvements, investing for the future, and other items that your home loan assist with. Your mortgage can be an important instrument in helping your family lead a Richer Life.

Nestworth Financial Solutions Pty Ltd and its Mortgage Advisers are Authorised Credit Representatives of Australian Finance Group Ltd ACN 066 385 822 (AFG) Australian Credit Licence 389087.

How can we help you?

We work in partnership with you to advise, protect and grow your wealth with financial strategies tailored to help you secure your financial future.

With monthly progress monitoring, we are there to keep you on track for success and help navigate you towards achieving your idea of richer living.

Frequently asked question

If you’ve had your current home loan for more than 3 years, chances are there is a better product out there that’s more suited to your current needs. After all, a lot has probably happened in your life during his time – and interest rates have certainly changed!

Your loan might not have the features or flexibility other loans can offer, and your financial situation may have outgrown your current mortgage. That’s why we suggest you should review not just your home loan, but your entire financial plan at least every couple of years.