But you can’t control the life events that can impact these, and when this happens the impact to you and your family can be devastating, so it makes sense to consider your options.

What would happen to your plans if you were suddenly unable to work?

What would happen to your assets and financial situation if the worst were to happen?

Do you know how much insurance you need or hold?

Do you understand what insurances are available?

What insurances may be needed to protect your family and/or your assets?

We can help you understand your needs based on your situation and goals. We can then provide you options, all designed to protect you, your assets and the ones you love without impacting the ability to achieve your goals.

Life Insurance

When it comes to your assets, there’s none bigger than your life. Life Insurance provides cover to take care of your loved ones if the worst was to happen to you. Generally speaking, Life Insurance pays out a lump sum amount in the event of death. Your family can use this to pay off your mortgage, cover ongoing living expenses and invest it for future expenses.

Trauma & Critical Illness Cover

Trauma Insurance provides a lump sum amount on the diagnosis, or occurrence, of one of a list of specific injuries and illnesses such as heart attack, cancer, or stroke.

Did you know? You have a one in three chance of suffering a major illness between the ages of 30 and 64.

Trauma & Critical Illness Insurance relieves the financial burden a serious illness can cause. The proceeds can be used for anything you choose and can offset expensive medical bills and provide additional funds to complement Income Protection payments whilst you recover.

How can we help you?

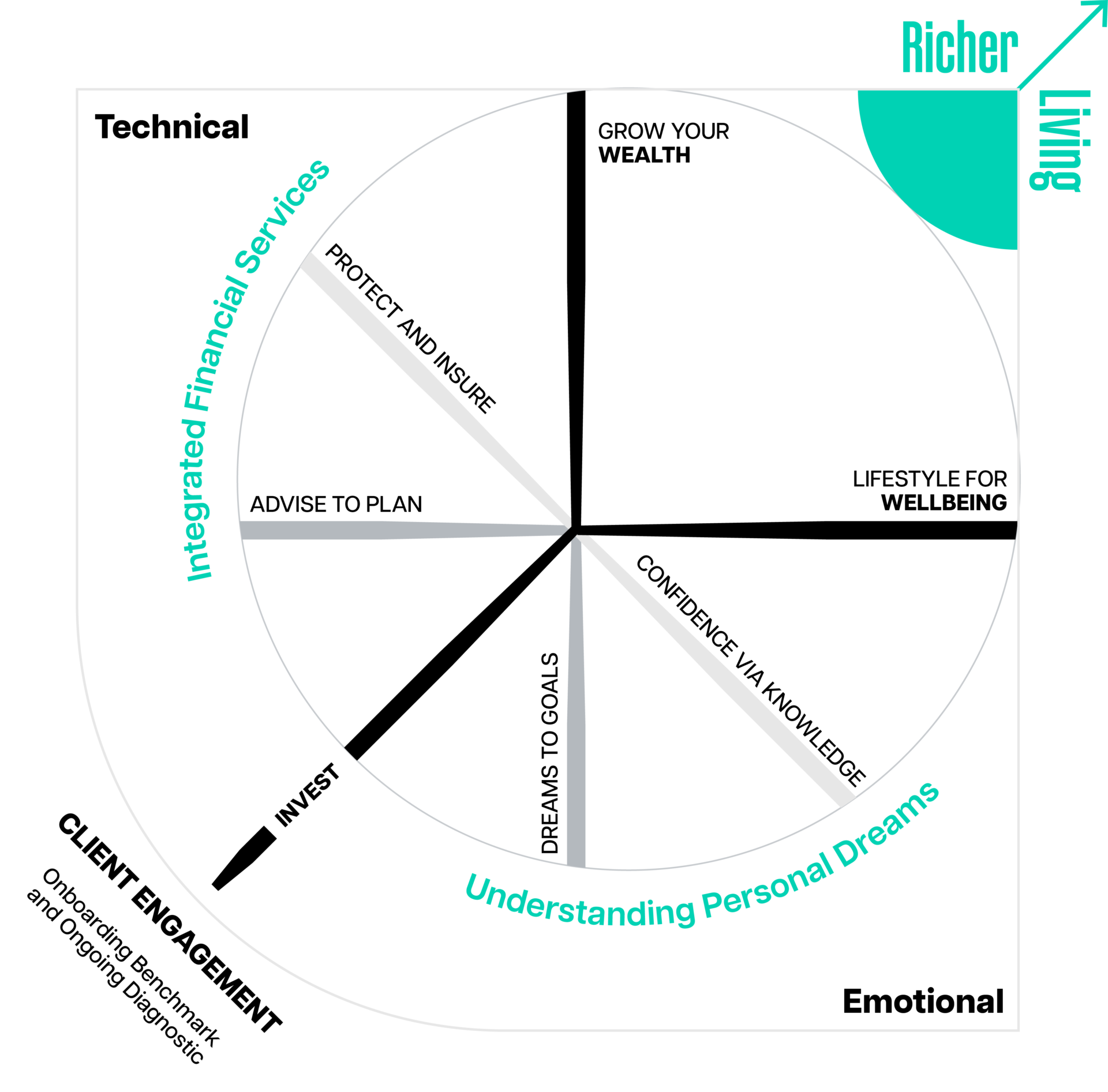

We work in partnership with you to advise, protect and grow your wealth with financial strategies tailored to help you secure your financial future.

With monthly progress monitoring, we are there to keep you on track for success and help navigate you towards achieving your idea of richer living.

Frequently asked question

We agree! A lot has changed with personal insurances over the past few years, so we recommend a full review of your cover. You may find you can get the same cover for smaller premiums, or even that you have cover you don’t need. If you require increased cover to protect your family, your Nestworth financial strategist will advise the most cost-effective way of attaining this.