All you need is self-discipline and a good level of financial literacy, along with a comprehensive understanding of your current financial position, a clear idea of your long-term goals, and a realistic plan to achieve them.

It’s then just a matter of closely monitoring your financial plan to ensure its ongoing effectiveness, as well as having a fall-back position for when life throws its inevitable unknowns into your path. Like we said… it’s not complicated.

Yet if you’re thinking that’s all a little much for one or two people to handle, well… we agree with you.

That’s why at Nestworth we’ve made it our mission to assist everyday Australians to create wealth for themselves, by providing the resources, education, and partnerships they need to achieve success.

How can we help you?

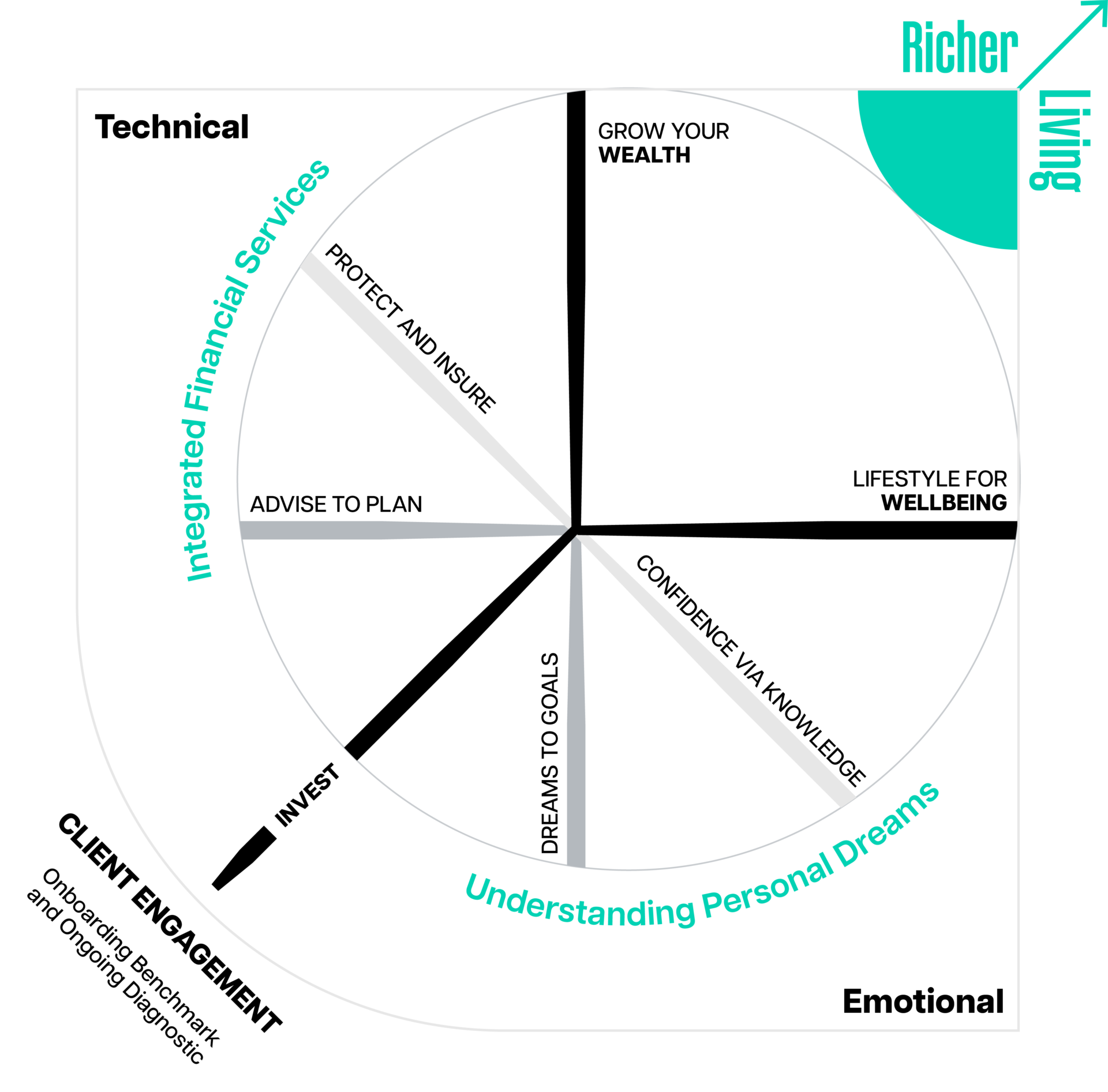

We work in partnership with you to advise, protect and grow your wealth with financial strategies tailored to help you secure your financial future.

With monthly progress monitoring, we are there to keep you on track for success and help navigate you towards achieving your idea of richer living.

Frequently asked question

It starts with the right desire and attitude. It also helps to have a stable income or two in your household, and a level of savings. That could even be in the form of increased mortgage payments you’ve made. You might be surprised what our strategies can achieve over time.